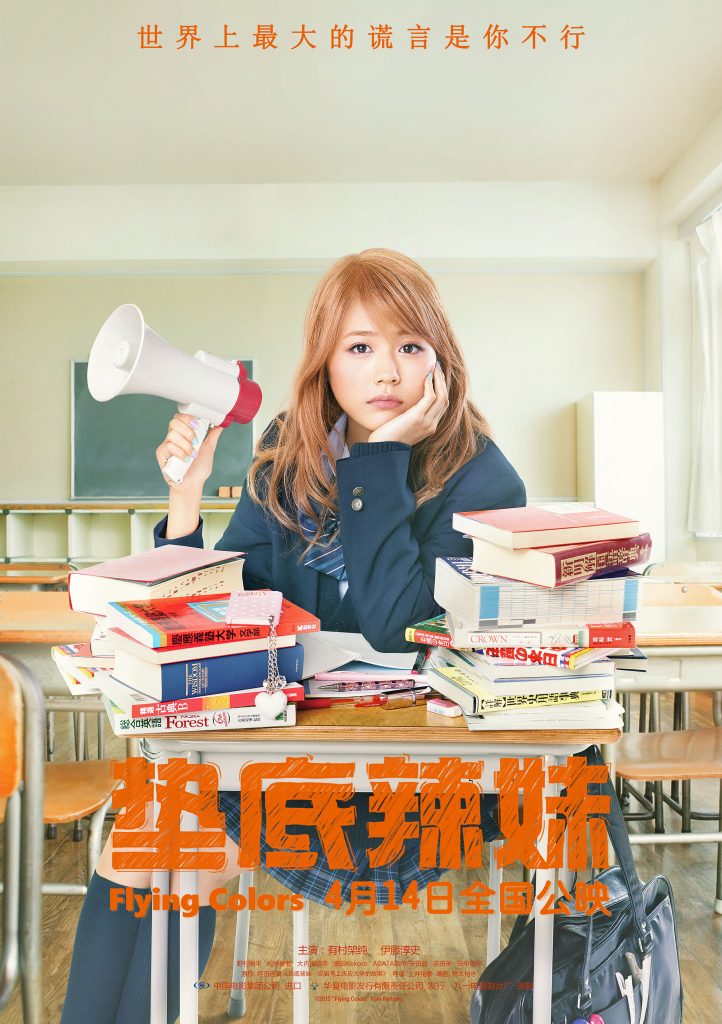

一直想给辰辰列一个电影推荐清单,虽然辰辰目前还是一听到电影就完全抗拒。最近突然看到了一篇这部电影的推文:一西安妹子在高中遭遇家庭变故后,突然发奋从学渣到考上清华的经历。那就从这部开始吧。这部电影分级为SAFR-12+(SAFR is for suitable age for Raisin)。记忆中没啥儿童不宜的镜头(没时间再看一遍啦~~),但是电影中关于决定以及决定之后的责任太小年纪可能体会不到。想象应该在初二或高二的暑假陪辰辰一起看这部电影,正好可以助燃一把!!!

最近一年看的电影可能不到20部:资源里可能有不到10%有下的冲动,这里面有只有10%有看的冲动。这部日本热血剧按理来说不在我感兴趣的范畴,本人生性冷漠,看完热血剧可能热血不过一天,以后还是该干嘛干嘛——比起热血,我可能更爱黑色幽默。说来奇怪,这部电影资源一出就赶快下下来,然后趁着出差赶紧给看了。我是一个爱把事情想清楚的人,虽然更多时候是瞎想~~如今我已经放弃把爱情这档子事想清楚的想法啦,早年看了太多浪漫爱情故事,完全给我带偏了,坚决不让辰辰在18岁之前看啥浪漫爱情电影。其实现在想来,现在所处的时代注定了爱情的平庸,要真要啥惊天地泣鬼神的爱情,只能像“古战场传奇”里的女主角穿越到古代战场去:平均每两集来一次生死考验,这才配得上我以前所谓的爱情。关于人生呢,我可能到老了也想不明白,这个议题太过于庞大。而这部电影以及每个人都可以大谈特谈的高考经历牵出了我对那段时间的一点点小思考。

我说过很多浅显易懂的道理,我却是到了很大年纪才明白:比如看着别人的完美总以为多是天赋使然,但是却到了很老才明白常常的情况是“practice make perfect”。其实很简单的,定一个目标,然后努力最好是偏执的完成它,真是一个多么简单的事情。但是事实往往是我没有目标;或是好不容易有一个很模糊的目标,但我对于事情能否完成并没有迫切的关心。但是这并不说我没有努力过~~只是由于目标不明确+缺乏偏执完成的决心,使得我所谓的努力往往是文不对题或是方向性错误:

小学时终于当班长得到拿粉笔的任务,结果自认为非常礼貌的去找老师领了一回粉笔就被投诉说我没有礼貌,原因是没叫“老师”;

初中好不容易因为老师的鄙视目标明确的努力了一把,咸鱼翻身之后由于没有持续明确的目标就没有下文了;

高中的时候本该早恋+努力学习的时候却把精力都耗费在了跟突如其来的拆班分班、老师、教育体制……闹别扭上;

最让我无语的研究生阶段,在网上不厌其烦地投了几乎所有能够上边的外企简历,回了无数个各种变态的问题,只换来寥寥几份面试,“请问你有什么实习经验?”what??读研找工作还需要实习吗?不是要专心做实验发文章的吗?“实习”?是指去麦当劳打工?去商场门口当促销吗?——大姐,我真想回去抽你两巴掌,大公司的寒假、暑假“internship”你知道要去网申吗?……

Anyway, my point is, 驱动力往往比努力还要来的有实际效用,对于一个从来没啥明确目标、缺乏耐心+whatever works的妈妈来说,辰辰你可能不能指望太多,希望在你的人生重要关口能够找到能使你偏执努力一把的驱动力。好吧,说到底还是自己太懒,这篇文都是去年十月差个结尾一直拖到现在~~~